Irs compound interest calculator

Interest earned in your annuity compounds tax-free until you begin making withdrawals which means your value can grow at a far faster rate. One essential piece of information.

Business Calculators Online For Windows

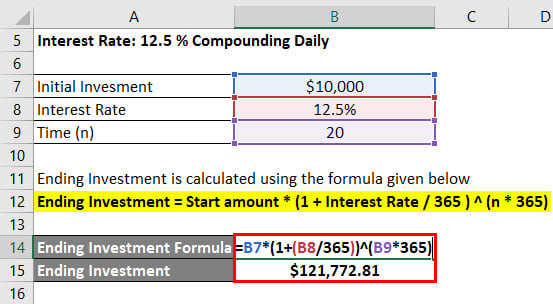

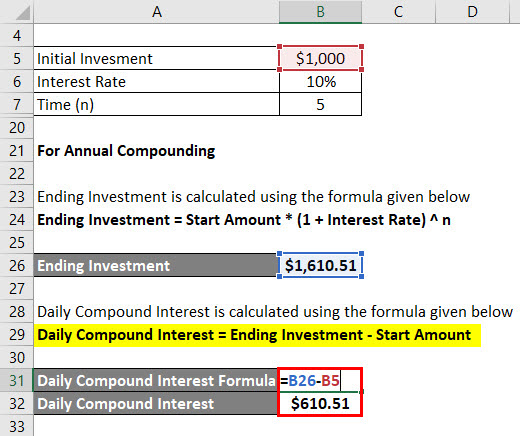

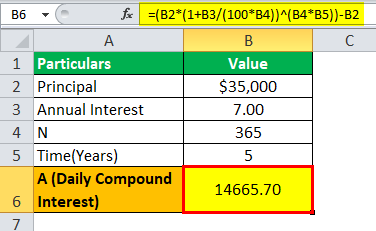

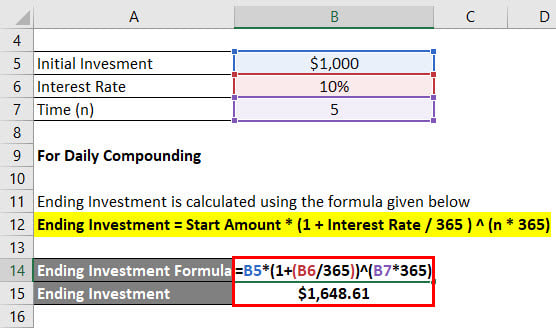

The following formula can be used to find out the compound interest.

. 401K and other retirement plans. Interest payments from the IRS are taxable. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Savings bonds and treasury notes and bonds is reported in box 3 of Form 1099-INT. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

The Debt Payoff Calculator uses this method and in the results it orders debts from top to bottom starting with the highest interest rates first. The IRS requires zero-coupon bond holders to pay tax on the phantom imputed interest income just as they would if they had received coupon payments even though there wasnt any interest. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account.

This means the IRS requires you to pay estimated taxes throughout the yeareither via withholding from paychecks or by making. Our Perpetuity Calculator is developed with only one goal to help people avoid hiring accountants. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Municipal bond interest is reported in box 8. Taxable interest is reported there. A contribution is the amount an employer and employees including self-employed individuals pay into a retirement plan.

The interest rate for underpayments by individual taxpayers for the fourth quarter of 2022 is 6. Compound Interest is calculated on the principal amount and also on the interest of previous periods. The IRS will.

However if youre not able to resolve a tax iss. Look at box 1 of any 1099-INT forms you receive. According to the IRS under Section 197 some assets are not considered intangibles including interest in businesses contracts land most computer software intangible assets not acquired in.

As of April 1 2022 the current interest rate is 4. In other words a credit card with an 18 interest rate will receive priority over a 5 mortgage or 12 personal loan regardless of the balance due for each. It increased a full percentage point from the third quarter of 2022 and 3 from Q4 2021.

The IRS sets the rate each quarter at the federal short-term rate plus three percentage points. If you return the cash to your IRA within 3 years you will not owe the tax payment. CD Calculator Compound Interest Calculator Savings.

See IRS Form 1040-ES for copies of vouchers and details on these and other payment methods. Where A final amount including interest P principal amount r annual interest rate as decimal n number of compounds per. We all have received that notice from the IRS saying we left some income off of a return says Armstrong often an innocent mistake of overlooking a 1099 for bank interest or stock dividends.

First perpetuity is a type of payment which is both relentless and infinite such as taxes. You can make additional estimated tax payments to make up for a quarter with more income and you can also make your estimated payments weekly bi-weekly or monthly as long as you have paid enough by the quarterly due date. The Internal Revenue Service IRS mileage reimbursement rate is an optional amount recommended by the IRS to calculate certain taxpayer deductions.

The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term. There are limits to how much employers and employees can contribute to a plan or IRA each year. Compound It Compound Frequency Annually Semiannually Quarterly Monthly Daily.

A P1 rn nt. You can call the IRS at 1-800-829-1040 for general questions or refund status information. Fixed Deferred Annuity Calculator.

The penalty is essentially an interest charge. Limits on contributions and benefits. Each of them is connected.

The IRS outlines the interest rate every quarter. With the help of this online calculator you can easily calculate payment present value and interest rate. The portion of municipal bond interest thats generated from private activity bonds is reported in box 9.

This amortization calculator returns monthly payment amounts as well as displays a schedule graph and pie chart breakdown of an amortized loan. Its used to calculate the deductible costs of operating an automobile for business purposes traveling to medical appointments or testing and for purposes related to charitable causes. Range of interest rates above and below the rate set above that you desire to see results for.

In the US federal income taxes are a pay-as-you-go system. Click here for a 2022 Federal Tax Refund Estimator. Federal Income Tax Calculator 2022 federal income tax calculator.

Margill How To Calculate Collection

Compound Interest Calculator Wealth Meta

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Ci Formulas Calculator Interest Calculator Compound Interest Compound Interest Math

Compound Interest Investor Gov

Daily Compound Interest Formula Calculator Excel Template

Easiest Irs Interest Calculator With Monthly Calculation

How Can I Calculate Compounding Interest On A Loan In Excel

Compound Interest Definition Formula How It S Calculated

Indices Are The Best Way To Calculate Compound Interest

Indices Are The Best Way To Calculate Compound Interest

How Can I Calculate Compounding Interest On A Loan In Excel

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Step By Step Examples Calculation

Daily Compound Interest Formula Calculator Excel Template